Strata Tip of the Week – Understanding Strata Earthquake Insurance and the Earthquake Deductible

A lot of buyers, and even strata owners, are surprised to learn that under the Strata Property Regulation, earthquake insurance is not considered a major peril. This means strata corporations in British Columbia are not required to obtain earthquake insurance, even though the province is considered a high-risk earthquake zone.

1. If a Strata Does Not Have Earthquake Insurance

While most stratas do carry earthquake insurance, some do not. In those cases, a major earthquake could leave owners solely responsible for the cost of repairs or rebuilding, which can amount to hundreds of thousands of dollars per unit depending on the extent of the damage and the size of the strata corporation. For buyers, purchasing a unit in a strata that does not have earthquake insurance can create similar risks once they become owners.

If you live in, or are considering purchasing a unit in, a strata that does not have earthquake insurance, it is recommended that you speak with an insurance agent. They can help you understand:

What coverage options may be available to reduce your personal risk

What limitations or exclusions may apply

2. Why Understanding the Deductible Matters

When earthquake insurance is included in the strata’s policy and a claim is triggered, the strata corporation must pay the deductible. This cost is usually shared among all owners through a special levy based on unit entitlement, and the amount per unit can vary depending on factors such as the building’s insured value and deductible percentage.

Most insurance agents will simply ask owners or buyers what their share of the strata’s earthquake deductible is, rather than calculating the amount themselves. Because the calculation relies on specific policy and unit entitlement details, it is useful for owners and buyers to understand:

How the deductible is determined, and

Which documents are needed to calculate it correctly

This awareness helps ensure they have a more accurate understanding of their potential exposure in the event of a major earthquake. While many stratas provide owners with a schedule showing the earthquake deductible payable by each unit when they distribute updated insurance coverage information, owners should still understand how those figures were determined and ensure they are correct.

3. What the Numbers Show

At Condo Clear, we track data from thousands of strata document reviews completed across British Columbia. Based on this data, we have found that the average earthquake deductible for a strata unit in British Columbia is approximately $56,000.

However, this is only an average. Actual deductibles can vary significantly depending on factors such as:

The location and size of the building

The strata’s insured value

The percentage set for the earthquake deductible in the insurance policy

The unit’s share of common expenses (its unit entitlement)

These variations highlight the importance of reviewing your strata’s insurance policy to better understand the specific deductible you may be required to pay.

4. How to Calculate a Strata Lot’s Earthquake Deductible

Step 1: Gather the following information

The strata’s current insurance policy, which will show:

The Insured Value of the strata corporation

The Earthquake Deductible, shown as a percentage (e.g., 15%)

The strata lot’s Unit Entitlement, shown on the Schedule of Unit Entitlement:

If the Strata Plan was filed before July 1, 2000, the schedule is included on the plan

If filed on or after July 1, 2000, it is a separate document called the Form V: Schedule of Unit Entitlement

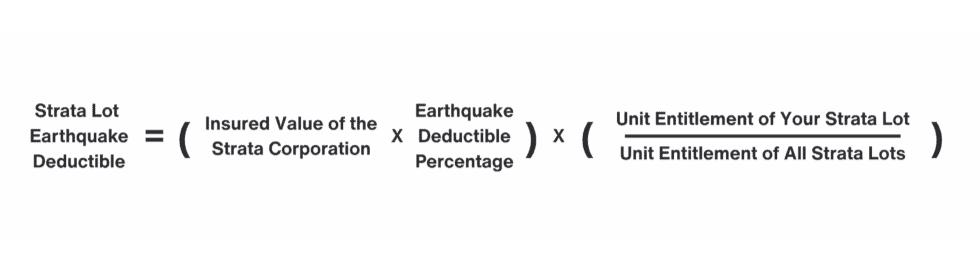

Step 2: Apply the following formula:

Example: If a strata has an insured value of $50 million and a 10 percent earthquake deductible, the deductible would total $5 million. Each owner’s share would then depend on their unit entitlement, which determines their percentage of ownership in the strata.

5. Obtaining Additional Coverage

Even when the strata corporation carries earthquake insurance, owners may want to consider obtaining additional homeowner insurance that covers their share of the strata’s earthquake deductible. This type of coverage is often referred to as earthquake deductible assessment coverage. It helps protect owners from having to pay their portion of a potentially very large deductible out of pocket.

When looking into options, it is a good idea to:

Speak with several insurance companies to compare available coverage

Review the limits and exclusions in each policy

Compare costs, as coverage and rates can sometimes vary significantly between brokerage

While earthquake insurance is not mandatory for stratas in BC, understanding whether it is in place, knowing how the deductible works, and exploring available coverage options can help both owners and buyers make informed decisions and better protect themselves financially. Reviewing the strata’s insurance policy each year and keeping owners informed about deductible amounts can also help everyone be better prepared if an earthquake occurs.

At Condo Clear, we review strata documents every day and share these insights to help buyers and owners feel more confident in navigating strata living. Sign up for our Strata Tip of the Week Newsletter today to stay up to date with the latest strata news and articles.

That’s it for this week. If you have any suggestions for other topics you’d like us to cover, please let us know at info@condoclear.ca.

Author: Mugurel Mic

Disclaimer: The information provided is for general purposes only. It is not intended to provide legal advice or opinions of any kind. No one should act, or refrain from acting, based solely upon the materials provided, any hypertext links or other general information without first seeking appropriate legal or other professional advice.

A little about Condo Clear:

They are a fully licensed brokerage under the BCFSA, and carry Errors and Omissions (E&O) insurance.

They have been in business since 2017 and have completed over 3,000 strata reviews to date province-wide.

Their Review Advisors have firsthand knowledge and experience. They’ve all been practicing strata managers.

FAQs: How do Condo Clear’s services work?

Pricing: How much do Condo Clear’s services cost?

Learn More: https://condoclear.ca/

Categories

Recent Posts