- Home

- Search

- Nanaimo Single Family Homes

- Nanaimo Condos

- Nanaimo Multi-Family Homes

- Nanaimo Manufactured Homes

- Nanaimo Vacant Land

- Nanaimo Mountian Views

- Nanaimo Ocean Views

- Nanaimo Ocean View Condos

- Nanaimo Waterfront Homes

- Nanaimo Income Properties

- Nanaimo Homes Under $750,000

- Nanaimo Homes Under $650,000

- Nanaimo Homes Under $550,000

- Nanaimo Foreclosures

- Nanaimo Price Reductions

- Nanaimo Sales

- Nanaimo Open Houses

- Communities

- Sell

- Buy

- Resources

- About

-

- Register

- Sign In

- Advisor Emailjohn@johncooper.ca

- Advisor Phone+1(250) 619-9207

Stay informed with our real estate blog

Get market updates and the inside scoop from our professional insights.

’Tis the Season to Slow Things Down

I’m well aware of the irony: I’m filming this from a beach in Mexico 🌴 while telling you about the "coldest" window in the real estate market. But here’s the reality you won’t hear in a typical sales pitch: Optimally, right now is NOT the time to buy or sell. 🚫 If you’re scrolling through

Read More

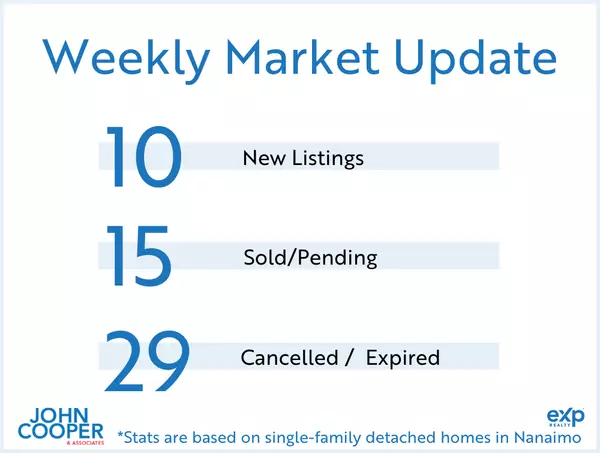

Weekly Real Estate Take - December 2025 - Week 4

Market activity is finally starting to slow after a busier than anticipated end to 2025. 10 single-family homes were introduced to the market last week. That was 5 less than the week prior. 15 Nanaimo homes sold last week. That was down from 23 the previous week. I am forecasting the first quarter

Read More

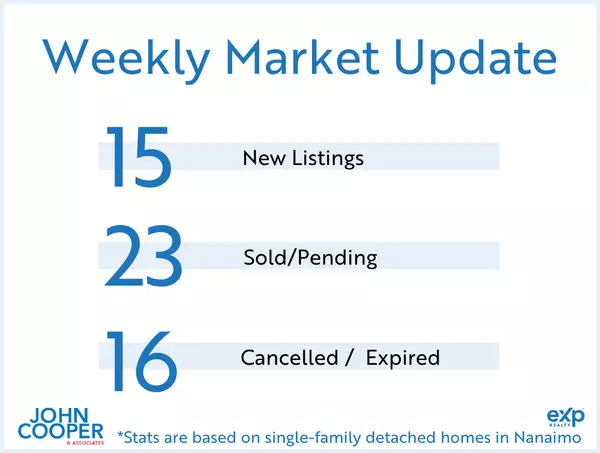

Weekly Real Estate Take - December 2025 - Week 3

Just when things are supposed to slow down Nanaimo single-family home sales doubled compared to the previous week. 23 homes sold last week, compared to 11 the week before. Despite my predictions for market activities to slow, activity has increased. I suspect this is just a pre-holiday flurry of ac

Read More

Consistency: The Bridge Between Showing Up and Levelling Up

The power of consistency changed my life.For the first twenty years, I believed athletic ability was something you were either born with or you weren’t. Then I found Brazilian Jiu-Jitsu.Testing myself against people my size revealed something I’d been missing: success isn’t about talent. It’s about

Read More

Strata Tip of the Week – When Is a Depreciation Report Outdated?

A depreciation report can become outdated far sooner than many people expect. In some cases, information in the report may begin to lose accuracy only a year or two after the report is completed. The answer depends on how well the report’s assumptions still match real-world conditions, and how much

Read More

Weekly Real Estate Take - December 2025 - Week 2

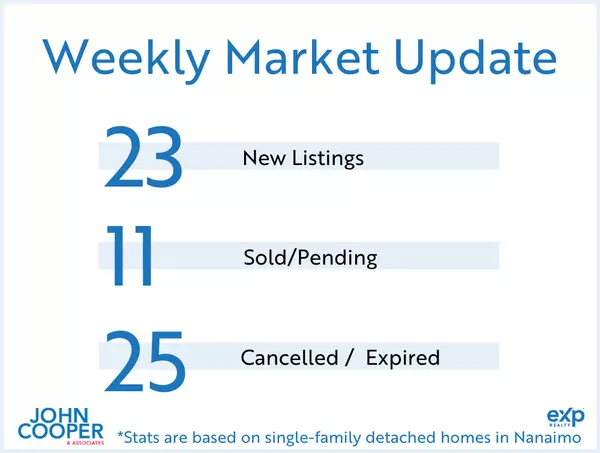

Last week 23 single family detached homes were introduced to the Nanaimo market. In that same time frame 11 homes sold and 25 listings expired. Many of the expired homes will not be relisted until 2026. Anecdotally, December has been a busy month for Nanaimo real estate. Statistically prices have he

Read More

December 2025 Newsletter

December 2025 The ‘12 months to date’ statistics now include most of 2025 and it is very interesting to observe how it compares to 2024. Some of the most notable observations are contrary to the popular Canadian real estate narrative. Total inventory has stayed very similar to 2024 levels (units li

Read More

The Silent Power of a Trusted Agent

When you’re selling your home, the reputation of the agent you choose becomes a silent force in every negotiation.A well-respected agent brings confidence, credibility, and control to the table. Other agents know how they work. They know the standards they hold. And they know they negotiate firmly,

Read More

The Power of a Team, The Accountability of One Trusted Advisor

Real estate has changed a lot in the last 18 years. These days you can hire a “team,” a “mega team,” or a team so big you’re not even sure who’s actually selling your house 😅. But here’s what Nanaimo homeowners really want: A true neighbourhood expert 🏡 An experienced advisor, not someone cu

Read More

Strata Tip of the Week – This Strata Is Not Following the Law: Can the CRT Help?

Strata corporations in British Columbia operate within a fairly complex legal framework. While the Strata Property Act is the primary legislation governing how stratas are created, managed, and governed, it’s not the only law that applies. Depending on the issue, strata corporations may also need to

Read More

Weekly Real Estate Take - November 2025 - Week 4

Last week saw 32 single family homes get introduced to the Nanaimo market. This was a modest decrease from the previous week’s total of 38. Single family homes sales have increased, with 19 homes selling last week. This was an increase from the 15 sales that occurred the previous week. As of today,

Read More

The Power of Representaion

When you’re selling your home, the reputation of the agent you choose becomes a silent force in every negotiation.A well-respected agent brings confidence, credibility, and control to the table. Other agents know how they work. They know the standards they hold. And they know they negotiate firmly,

Read More

Strata Tip of the Week – How Strata Documents Help Tell the Real Story

When you buy a strata property, you’re not just buying the unit. You are also buying into the finances, maintenance history, governance, and long-term planning of the entire strata corporation. And a significant part of that story is reflected in the strata’s documents. At Condo Clear, we’ve reviewe

Read More

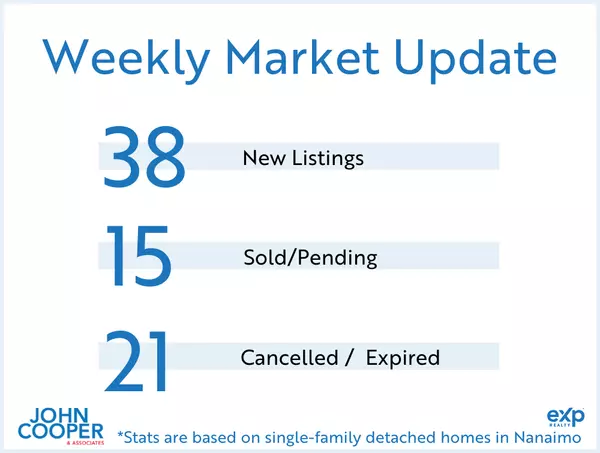

Weekly Real Estate Take - November 2025 - Week 3

In the last 2 weeks almost 70 single-family homes were introduced to the Nanaimo market. Those are big numbers considering we are only 38 days away from Christmas. Sales have declined since the previous week, with only 15 homes selling last week, down from 28 selling in the week prior. This is a goo

Read More

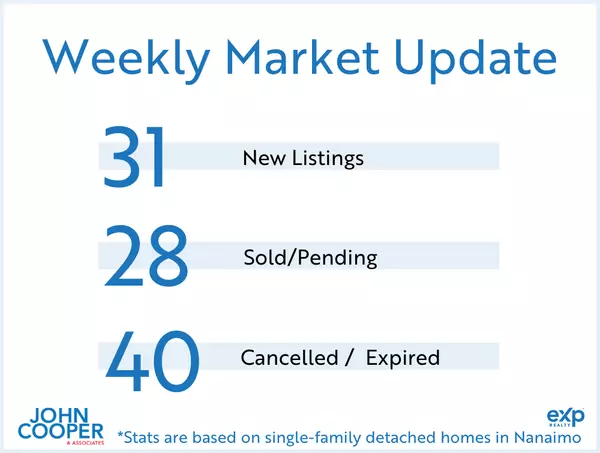

Weekly Real Estate Take - November 2025 - Week 2

Nanaimo's housing market showed a late burst of activity, suggesting homeowners are aiming for one final push in the 2025 market. Last week, new single-family home listings almost doubled, jumping from 16 to 31. Sales activity mirrored this impressive increase, with 28 Nanaimo single-family homes so

Read More

Subscribe to John's FREE Weekly Nanaimo Real Estate Newsletter

Are Nanaimo house values falling or rapidly rising? Every week, I post an ‘up to the minute’ take on the state of the Nanaimo residential housing market. Receive a weekly summary of sales in your neighborhood along with predictions for the future to help guide you. These are ‘Nanaimo specific’ s

Read More

November Newsletter 2025

November 2025 Last week the number of new homes listed in Nanaimo dropped by over 50% compared to the previous week. 16 homes were listed last week, down from 36 the previous work. 15 Nanaimo single-family homes sold last week, down from 18 the previous week. Year to date, the Nanaimo market is out

Read More

Strata Tip of the Week – The Problem With Depreciation Reports

As of July 1, 2024, strata corporations in BC with five or more strata lots must obtain a depreciation report and update it every five years. While the five-year update requirement now applies across the province, the timelines for when existing stratas must obtain or update their next report vary d

Read More

When ‘No Disclosures’ Means ‘Look Closer’

Guidance on Property Disclosure Statements 🏡When you’re under contract and in the due diligence phase, one of the most important documents to review is the Property Disclosure Statement (PDS).The PDS is the seller’s opportunity to answer standardized questions about the property — things like past

Read More

The Agent-Brokerage Relationship

Ever wondered how real estate really works behind the scenes? 🏡Here’s something most people don’t know — brokerages don’t hire agents.Agents are independent and actually choose which brokerage to affiliate with.That means every realtor you meet runs their own business and pays the brokerage — not t

Read More

Strata Tip of the Week – Watch Out for Stratas “Padding” Their Budget

Many strata corporations place a lot of emphasis on keeping strata fees low. While this is often a reasonable goal, it’s important to understand how stratas achieve it and how using existing savings to avoid fee increases can affect owners over the long-term. What Are Strata Surpluses and Deficits?

Read More

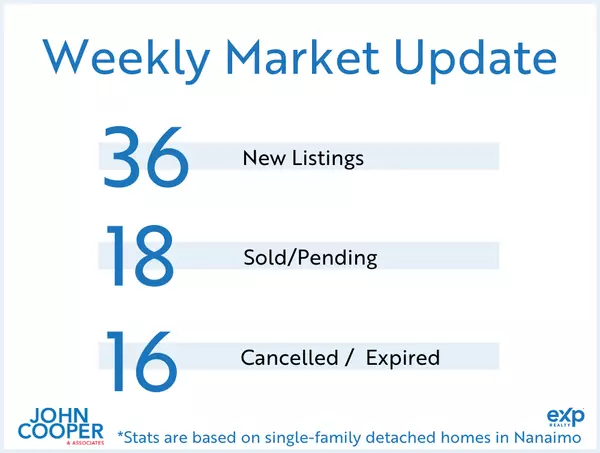

Weekly Real Estate Take - October 2025 - Week 4

As we near the end of October, Nanaimo continues to see a steady stream of single family homes being introduced to the market. 36 homes were launched last week, that is up from 31 homes, the week prior. Sales have been lower than months previous but increased subtly this week to 18 sales. That is up

Read More

Strata Tip of the Week – A Duplex is Still a Strata

Many owners and buyers are surprised to learn that most duplexes in British Columbia are actually strata properties. The distinction comes down to how the property is registered at the Land Title Office. If the property was created under a strata plan, it is legally a strata corporation, regardless

Read More

Poly-B Plumbing: What Every Nanaimo Homebuyer Needs to Know

Knowledge = Power in Nanaimo real estate. 💪Poly B plumbing discovered during your inspection?This video breaks down exactly what you should do—and what you should NEVER accept as a "solution".Your future self will thank you for watching this. ⬆️Contact me if you're in the Nanaimo area and have real

Read More

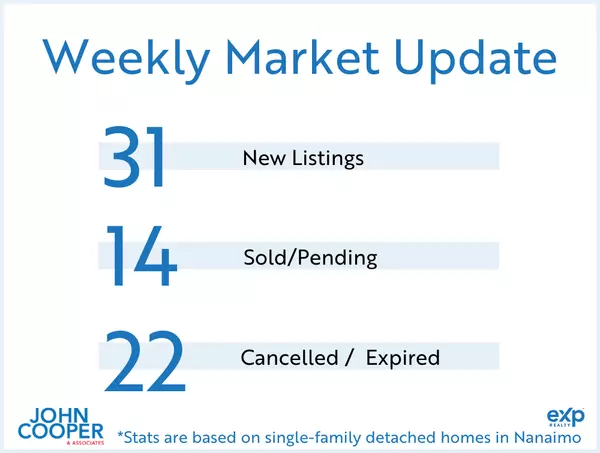

Weekly Real Estate Take October 2025 - Week 3

The number of single family homes listed in Nanaimo declined last week. 31 homes were introduced to the market, down from 41 the week prior. Sales have also declined. 14 homes sold in Nanaimo in the last 7 days. Down from 20 the week prior. Overall market sentiment is one of cautious optimism. The

Read More

Strata Tip of the Week – Understanding Parking and Storage in Strata Corporations

Parking and storage are often important features of strata living. Who gets parking stalls or storage lockers, how they are assigned, and whether those rights can change all depend on how those components are designated and how the strata corporation manages and allocates them. Because parking and s

Read More

Weekly Real Estate Take October 2025 - Week 2

The number of new single family homes listed in Nanaimo declined last week to 41 new options to choose from. That is down from 50 new options the previous week. Sales have seen a healthy increase, with 20 homes selling last week. That is up from 13 the previous week. As we head into the colder winte

Read More

Let's Talk Real Estate – The Kind Without Scripts.

Here's the thing about real estate content in 2025: there's more of it than ever, and that's actually great for buyers and sellers trying to make informed decisions.But I want to be real with you about something I've been thinking about lately.A lot of what you're seeing online, those perfectly sc

Read More

The Best Real Estate Brands Aren't Designed - They're Experienced.

A logo without a reputation is just a logo... Building a real estate brand that actually matters.When new agents reach out to me about building their brand, the conversation almost always starts with logos, websites, and business cards. I understand why. These are the tangible elements we associat

Read More

Strata Tip of the Week – Understanding Strata Earthquake Insurance and the Earthquake Deductible

A lot of buyers, and even strata owners, are surprised to learn that under the Strata Property Regulation, earthquake insurance is not considered a major peril. This means strata corporations in British Columbia are not required to obtain earthquake insurance, even though the province is considered

Read More