Making the Jump Into Vancouver Island Real Estate: How to Prepare Financially for Your First Home Purchase

Hello friends! Purchasing a home is a massive step and often the largest financial investment many people will ever make. As a professional real estate advisor, I understand that many first-time buyers may feel overwhelmed by the process and unsure of how to prepare financially. In this blog post, I will discuss how to prepare financially for your first home purchase from the perspective of a professional real estate advisor.

The first step in preparing financially for your first home purchase is to understand your credit score and work on improving it if necessary. Your credit score is an important factor in determining your mortgage rate and loan amount. A higher credit score will result in a better interest rate and more borrowing power.

Next, it's important to save for a down payment. A down payment is the initial payment made towards the purchase of a home and it is usually a percentage of the total cost. A larger down payment can help you qualify for a better mortgage rate and can also reduce the amount you need to borrow.

It's also important to save for closing costs which include expenses such as appraisal fees, title insurance, and legal fees. These costs can add up quickly and it's important to have enough saved to cover them.

Additionally, it's important to have a realistic budget in mind when purchasing a home. This includes not only the cost of the home but also the ongoing expenses such as property taxes, insurance, and maintenance. It's important to factor in these costs and make sure they fit within your budget.

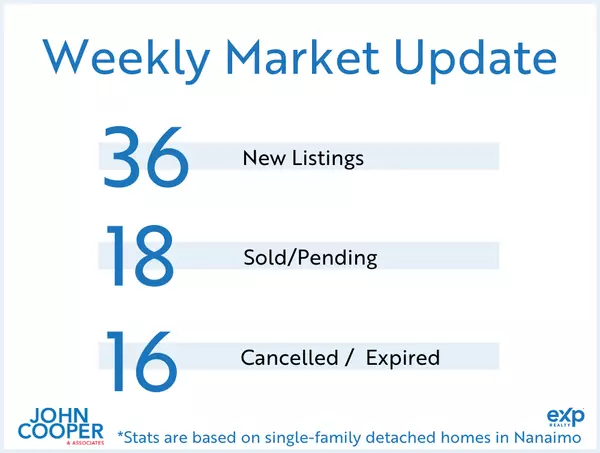

Another important step in preparing financially for your first home purchase is to be aware of the unique characteristics of the market you are buying in, such as the importance of being pre-approved for financing, the high demand for waterfront properties, and the importance of being prepared for bidding wars.

Lastly, consider hiring a financial advisor to help you create a plan and make sure you are on track to meet your goals. A financial advisor can help you create a budget, set savings goals, and provide valuable advice on how to make the most of your money.

In conclusion, buying a home is a big financial decision, it's important to be prepared by understanding your credit score, saving for a down payment and closing costs, having a realistic budget in mind, being aware of the unique characteristics of the market, and considering hiring a financial advisor to help you create a plan. By following these steps, you can make the jump into homeownership with confidence and peace of mind. As a professional real estate advisor, my goal is to provide guidance and support to first-time homebuyers throughout the process, including assisting them with financial preparation, so they can make an informed decision that aligns with their budget and goals.

Warmest of regards,

John Cooper

John Cooper Group - eXp Realty

250.619.9207

Categories

Recent Posts